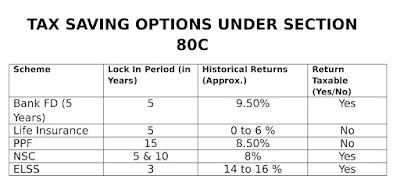

Tax-saving investment options can help you plan your annual savings. In this article I am going to discuss about the options which will help you to achieve your investment target.

Different banks offer different interest rate on the tax saving fixed deposits which range from 6.5- 8.7%. These plans are almost same as the regular fixed deposits plans. Taxes saving plans are come with a lock in period of 5 years and tax break under Section 80C on investments up to Rs 1.5 lakh. These schemes are suitable for the senior citizens who look for the low risk investment plans. One thing must be noted here that interest is not taxable.

It is usually known as NPS scheme. This scheme provides you an total tax saving benefit of Rs 2 lakh, 1.5 lakh under section 80C and Rs 50000 under section 80CCD (1B) of income tax act. To get this benefit you must have an investment account of National Pension Scheme. Please do visit on their website to know the more details and apply.

For many people, the investment that should make most sense is an ELSS. Salary earners normally have some of the allowable amount going into fixed income through PF deductions. And, to balance that, equity is advisable. It is a unique investment plan which is only viable tax-saving investment within Rs 1.5 lakh limit that fetches the benefits of equity returns.

Life Insurance can be considered as a default tax saving scheme used by the investors. It is covered under section 80C. The schemes of life insurance help a person to protect his or her family from any unpredicted incidents in the future and also giving the opportunity to save tax. Whereas the tax benefit can be reversed if anyone gives up the plan before 2 years.

It is issued by post offices and principal along with interest is backed up by the Govt. of India. Therefore, these are known as safe investment options. Now NSC’s are available for 5 year period and for a minimum investment of Rs 500 and in multiples of Rs 1,000, Rs 5,000 or Rs 10,000. There is no maximum limit for investment. Interest rates will be 8% per annum for the 5 year NSC from 1.10.2018. This rate changes on a quarterly basis and published by the Ministry of Finance.

Unit Linked Insurance Plans are most common products in which investors put their money. These schemes not only provide insurance cover, but also a comprehensive form of investment. The invested amount in ULIPs is put into shares and customers have freedom to choose how much of their money must be invested in shares. These are highly tax efficient policies and get the benefits under Section 80C of the Income Tax Act. The amount you will get at the end is also tax free.

There are many more tax saving schemes available - Health Insurance, Rajiv Gandhi Equity Savings Scheme, Debt Based Mutual Funds, Public Provided Fund, Heath Insurance, Senior Citizens Saving Scheme and Employee Provident Fund etc.

• Tax Saving Fixed Deposits

Different banks offer different interest rate on the tax saving fixed deposits which range from 6.5- 8.7%. These plans are almost same as the regular fixed deposits plans. Taxes saving plans are come with a lock in period of 5 years and tax break under Section 80C on investments up to Rs 1.5 lakh. These schemes are suitable for the senior citizens who look for the low risk investment plans. One thing must be noted here that interest is not taxable.

• National Pension Scheme

It is usually known as NPS scheme. This scheme provides you an total tax saving benefit of Rs 2 lakh, 1.5 lakh under section 80C and Rs 50000 under section 80CCD (1B) of income tax act. To get this benefit you must have an investment account of National Pension Scheme. Please do visit on their website to know the more details and apply.

• Equity linked Saving Scheme

For many people, the investment that should make most sense is an ELSS. Salary earners normally have some of the allowable amount going into fixed income through PF deductions. And, to balance that, equity is advisable. It is a unique investment plan which is only viable tax-saving investment within Rs 1.5 lakh limit that fetches the benefits of equity returns.

• Life Insurance

Life Insurance can be considered as a default tax saving scheme used by the investors. It is covered under section 80C. The schemes of life insurance help a person to protect his or her family from any unpredicted incidents in the future and also giving the opportunity to save tax. Whereas the tax benefit can be reversed if anyone gives up the plan before 2 years.

• National Saving Certificate

It is issued by post offices and principal along with interest is backed up by the Govt. of India. Therefore, these are known as safe investment options. Now NSC’s are available for 5 year period and for a minimum investment of Rs 500 and in multiples of Rs 1,000, Rs 5,000 or Rs 10,000. There is no maximum limit for investment. Interest rates will be 8% per annum for the 5 year NSC from 1.10.2018. This rate changes on a quarterly basis and published by the Ministry of Finance.

• Unit Linked Insurance Plans

Unit Linked Insurance Plans are most common products in which investors put their money. These schemes not only provide insurance cover, but also a comprehensive form of investment. The invested amount in ULIPs is put into shares and customers have freedom to choose how much of their money must be invested in shares. These are highly tax efficient policies and get the benefits under Section 80C of the Income Tax Act. The amount you will get at the end is also tax free.

There are many more tax saving schemes available - Health Insurance, Rajiv Gandhi Equity Savings Scheme, Debt Based Mutual Funds, Public Provided Fund, Heath Insurance, Senior Citizens Saving Scheme and Employee Provident Fund etc.